N Consulting Premium Financial Services

Consulting Firm – 10-year Financial Model

Consulting Firm – 10-year Financial Model

Couldn't load pickup availability

Consulting Firm – (10-year) Financial Model

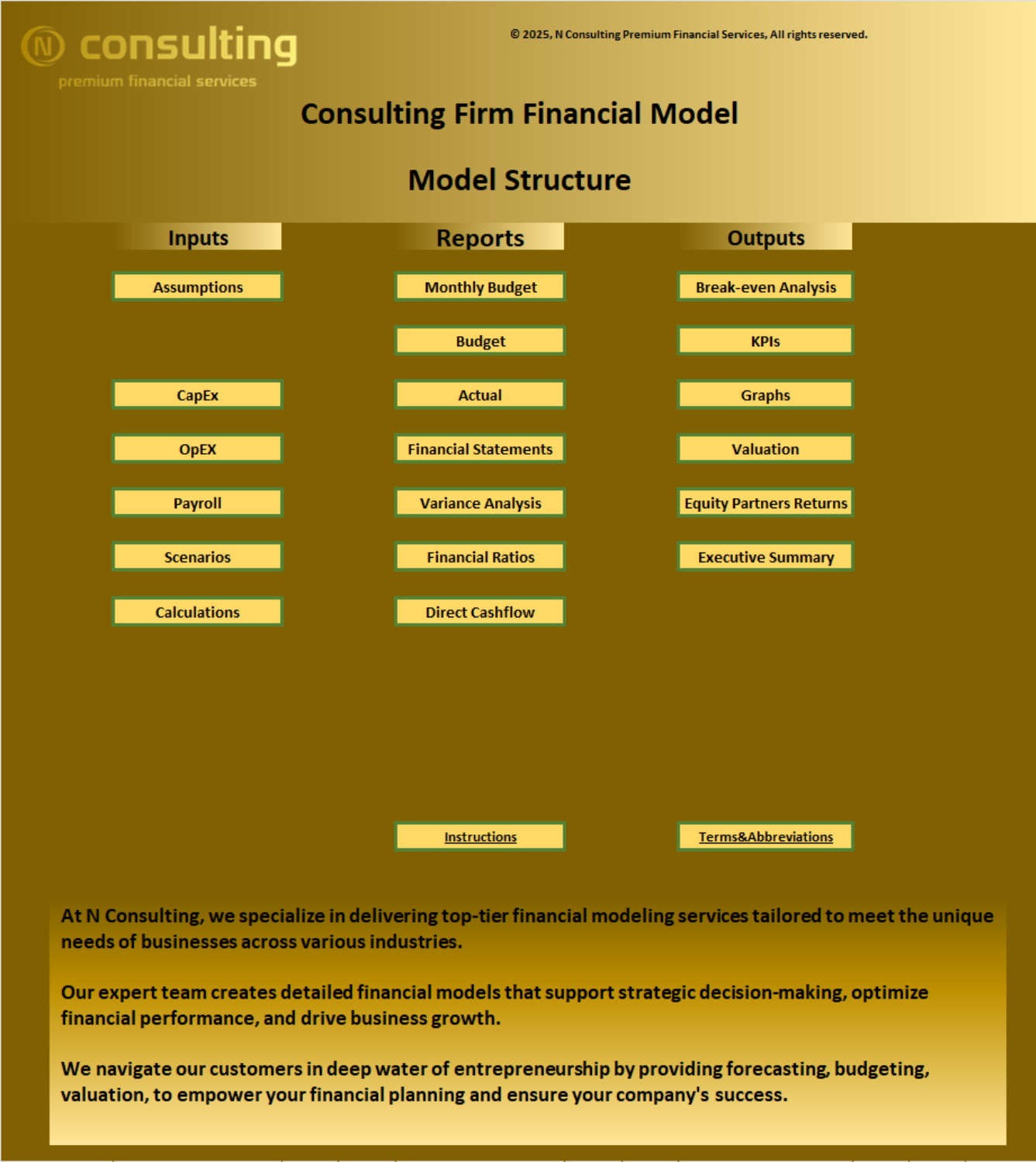

This financial model provides an advanced 10-year financial plan for a startup or operating Consulting Firm.

It is designed to provide a comprehensive overview of a firm’s financial performance. The model emphasizes the current financial health and future growth projections, offering detailed insights into its profitability and strategic value.

This fully customizable model can serve as a foundation for tailored financial modeling services. It is suitable for services sectors.

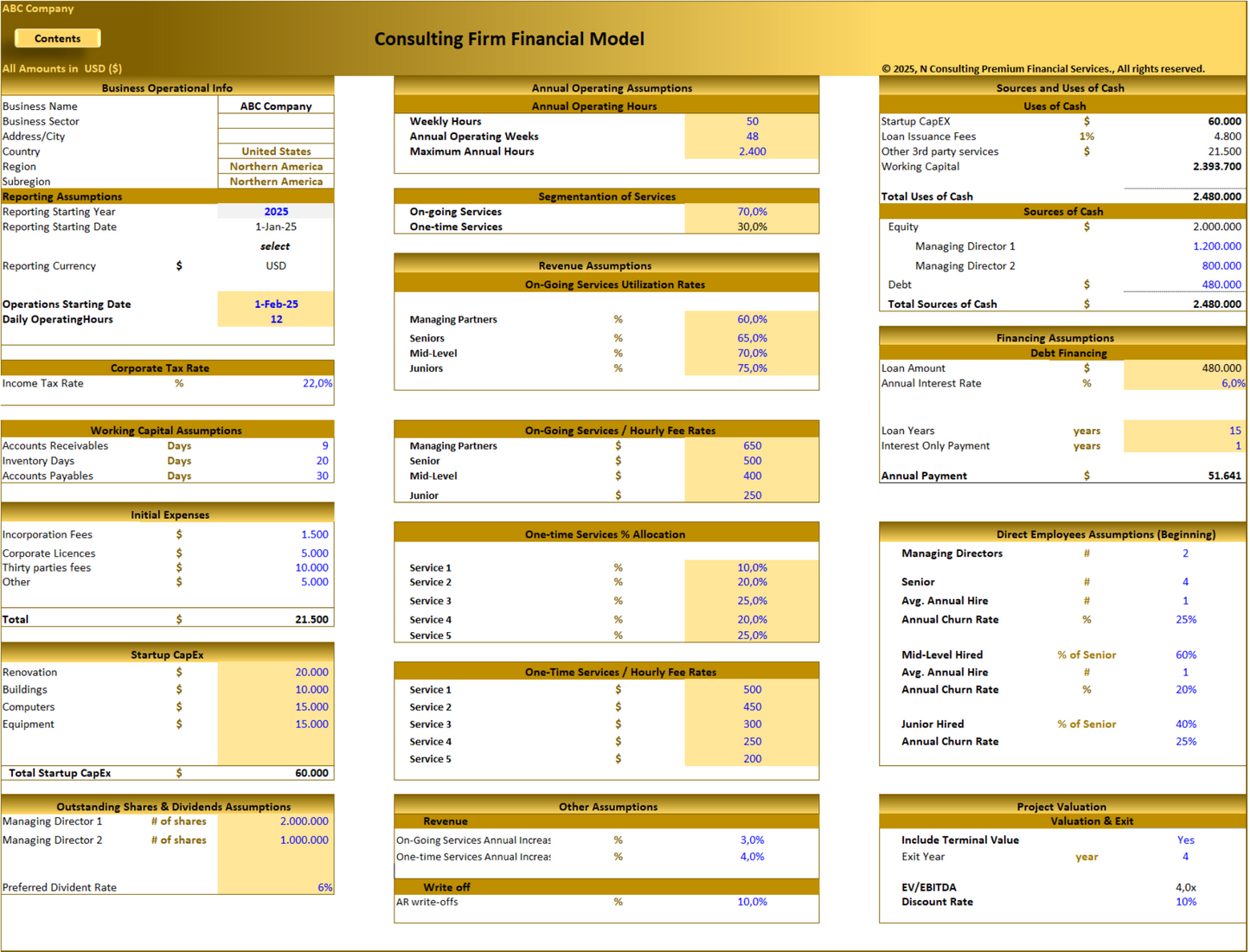

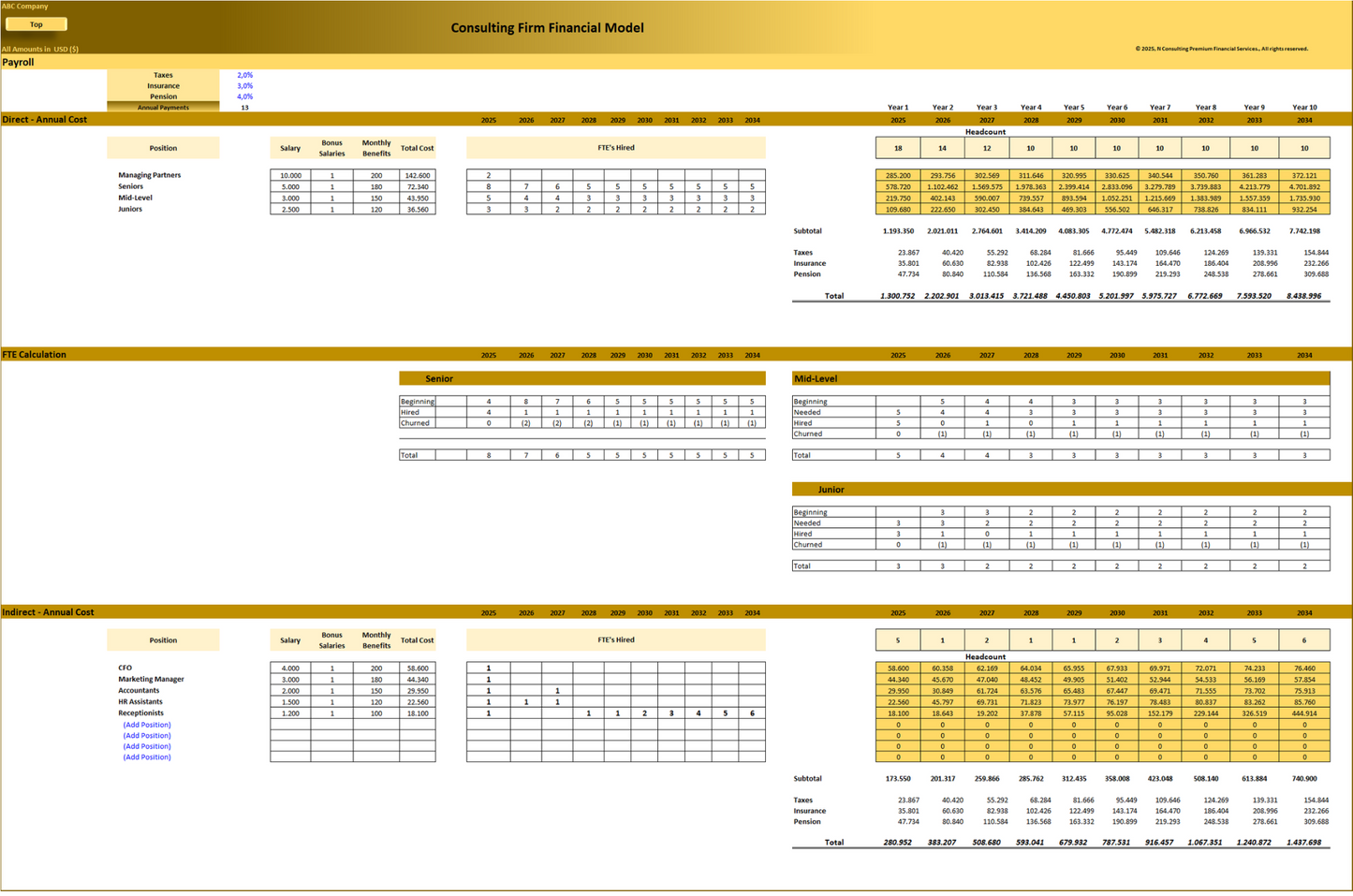

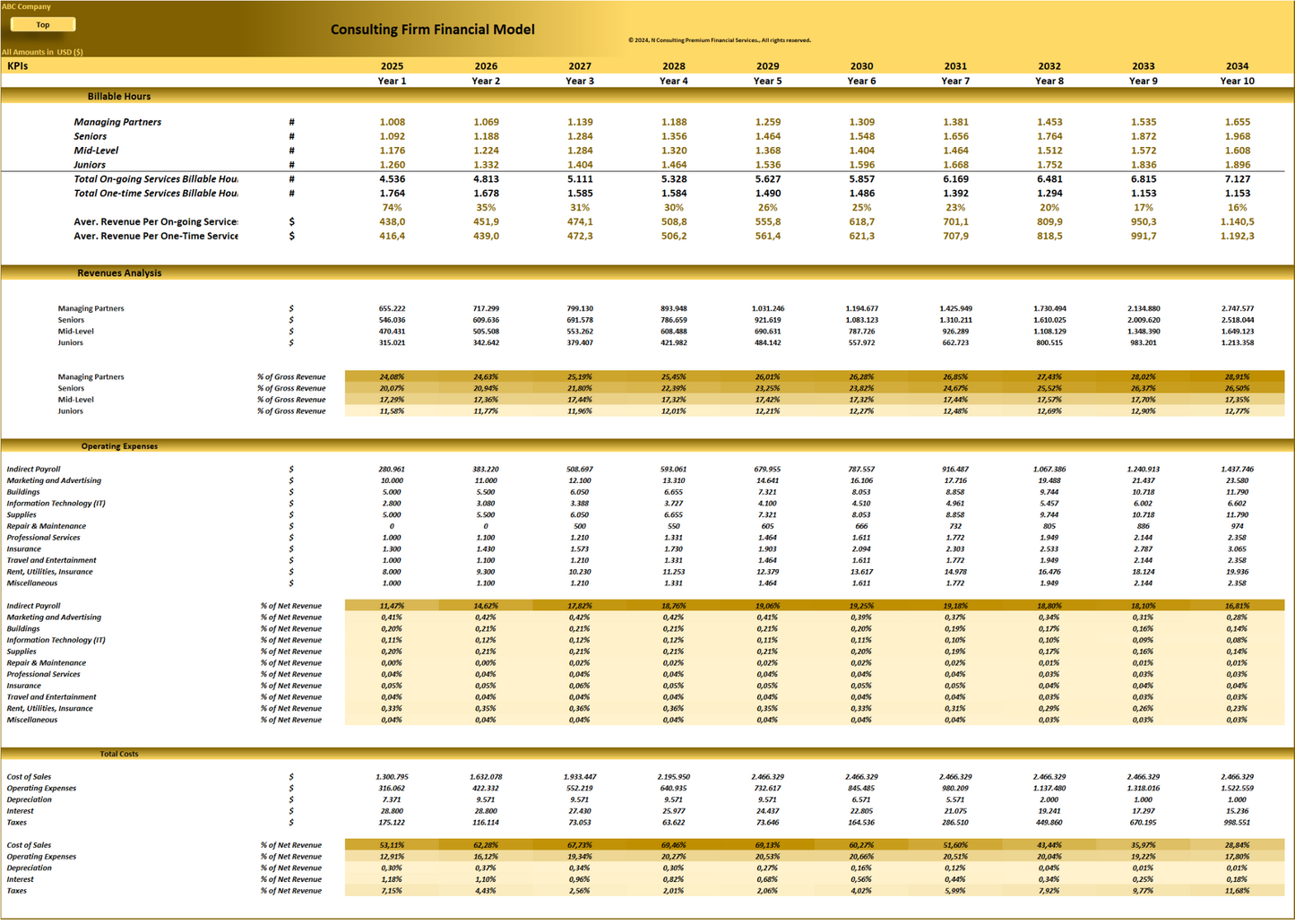

Model Assumptions and Inputs for the forecasted 5-year period are listed below.

- Starting Expenses / Sources & Uses of Cash / Billable hours / Two revenue channels / Working Capital Assumptions.

- Financing Assumptions / Managing Partners Outstanding shares

- Five main on-going services categories and five one-time services categories

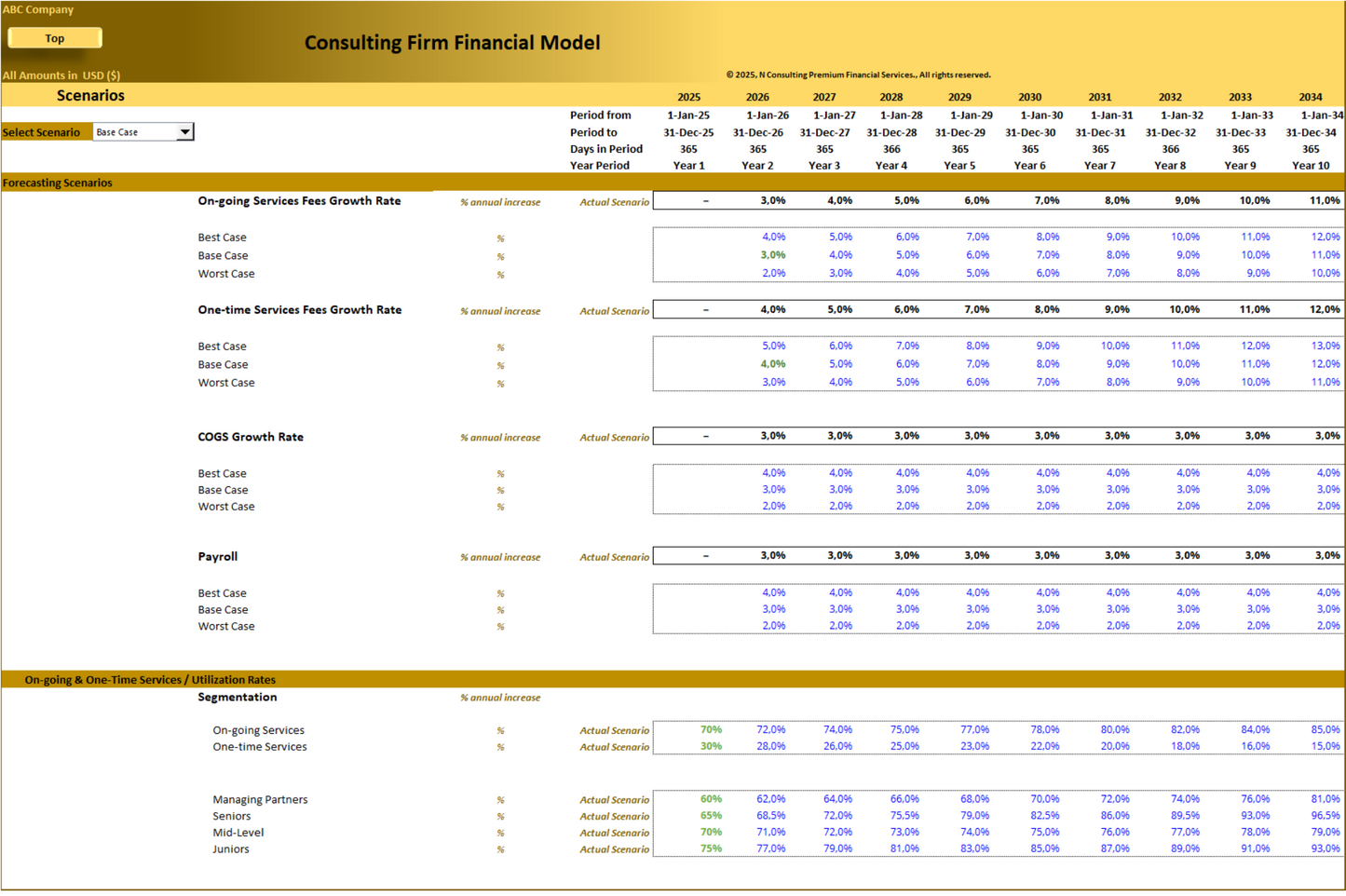

- Utilization Rates per level of employment.

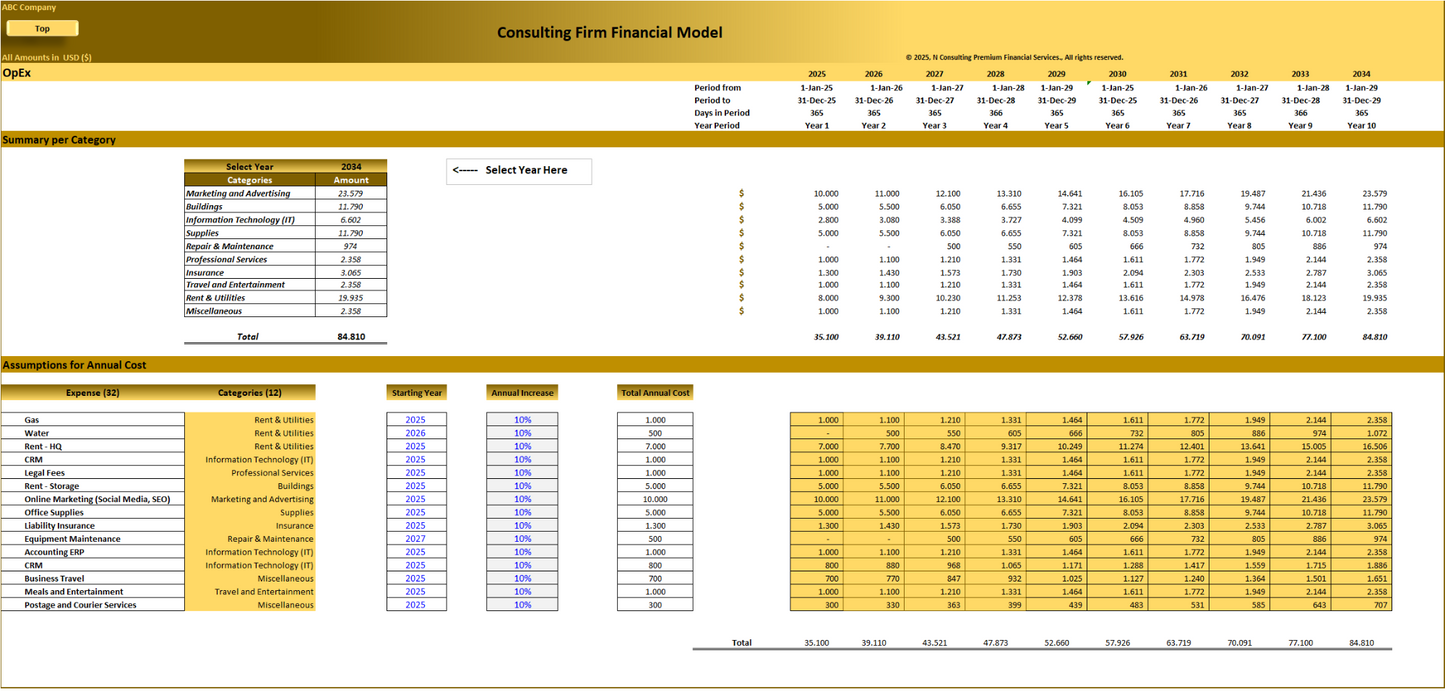

- Operating Expenses (with Starting Year and Annual Increase).

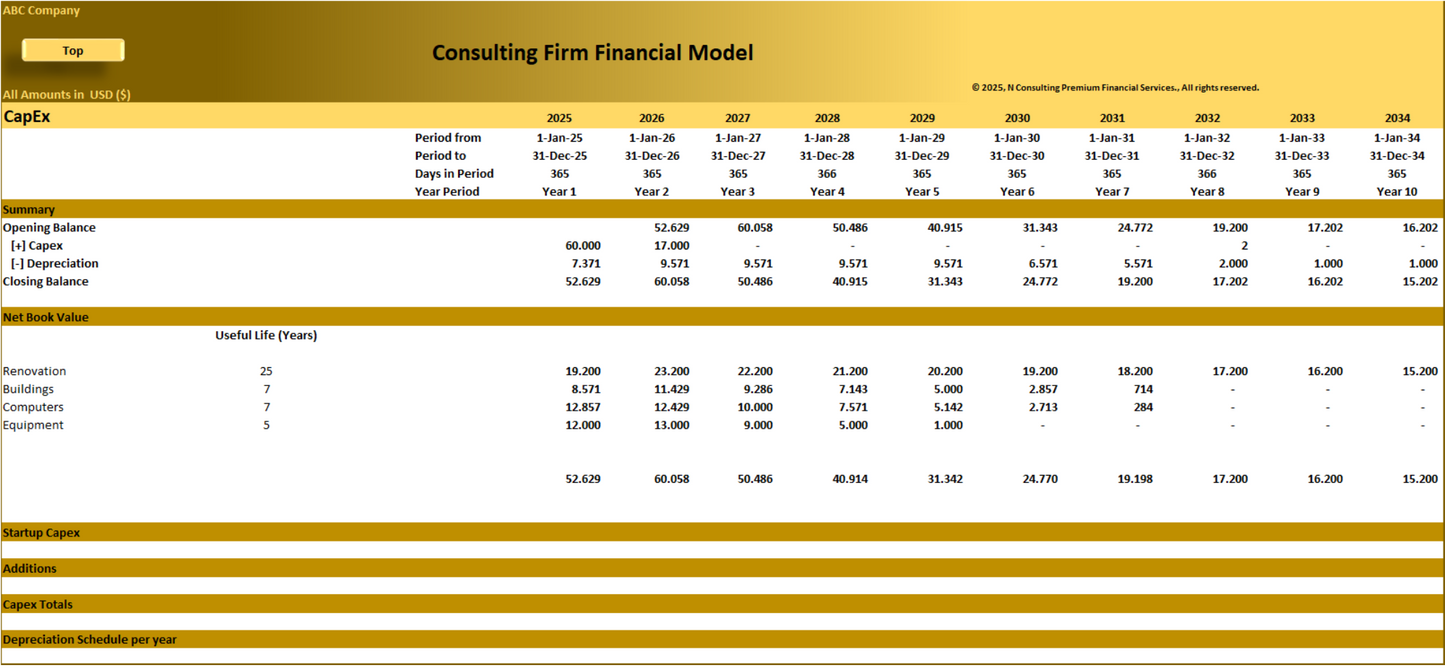

- Annual Capex, including Depreciation and Net Book Value. (Starting with CapEx Assumptions)

- Forecast Scenarios

The output sheets for the forecasted 5-year are listed below.

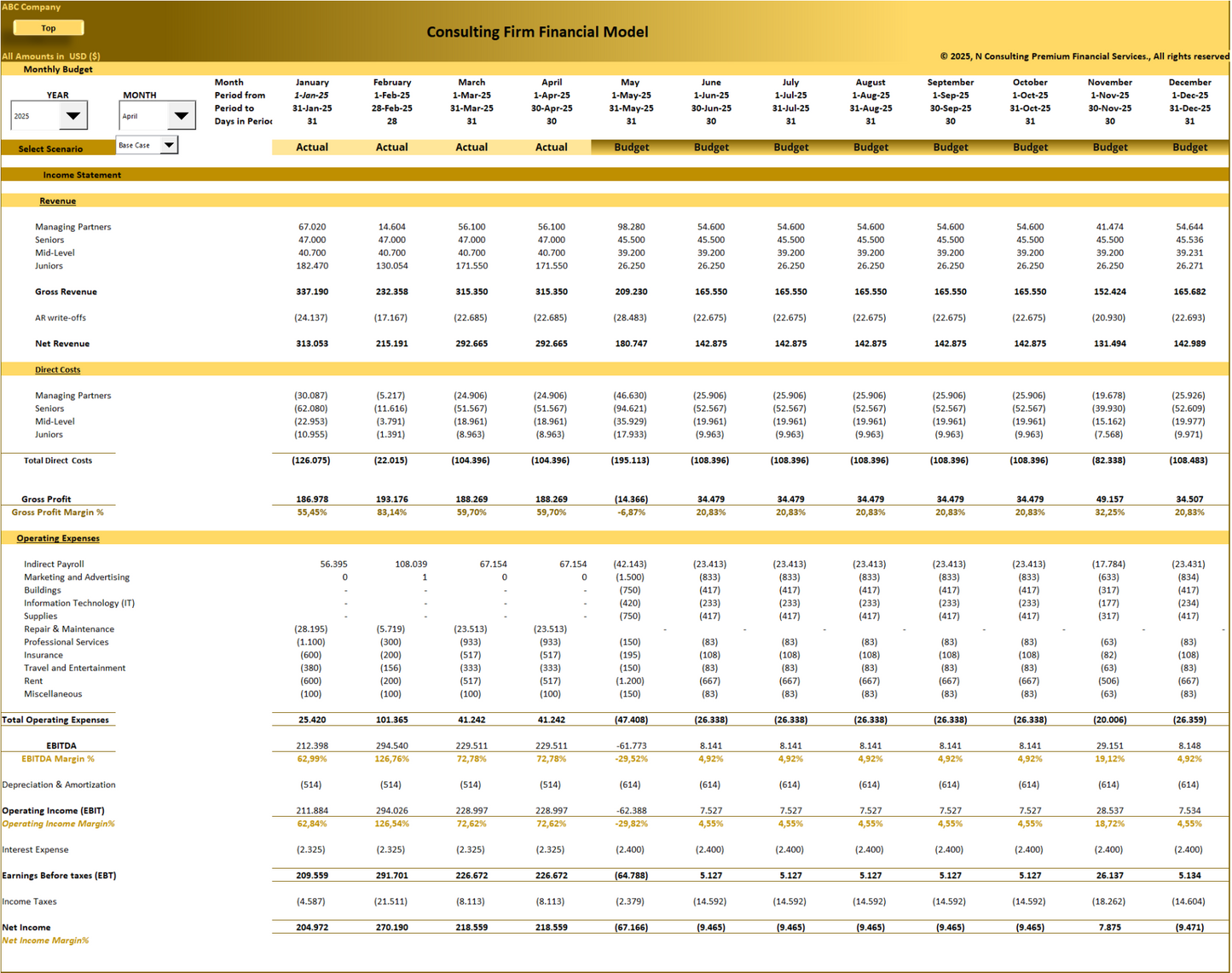

- Annual Profit & Loss by selecting and comparing month and year (dynamically change to Actual – Forecast)

- Monthly Budget (dynamically change according to assumptions)

- Monthly Actual (data should be inserted according to actual figures)

- Income Statement: Gross profit, EBIT (Earnings Before Interest and Taxes), and net profit calculations. Year-over-year growth analysis.

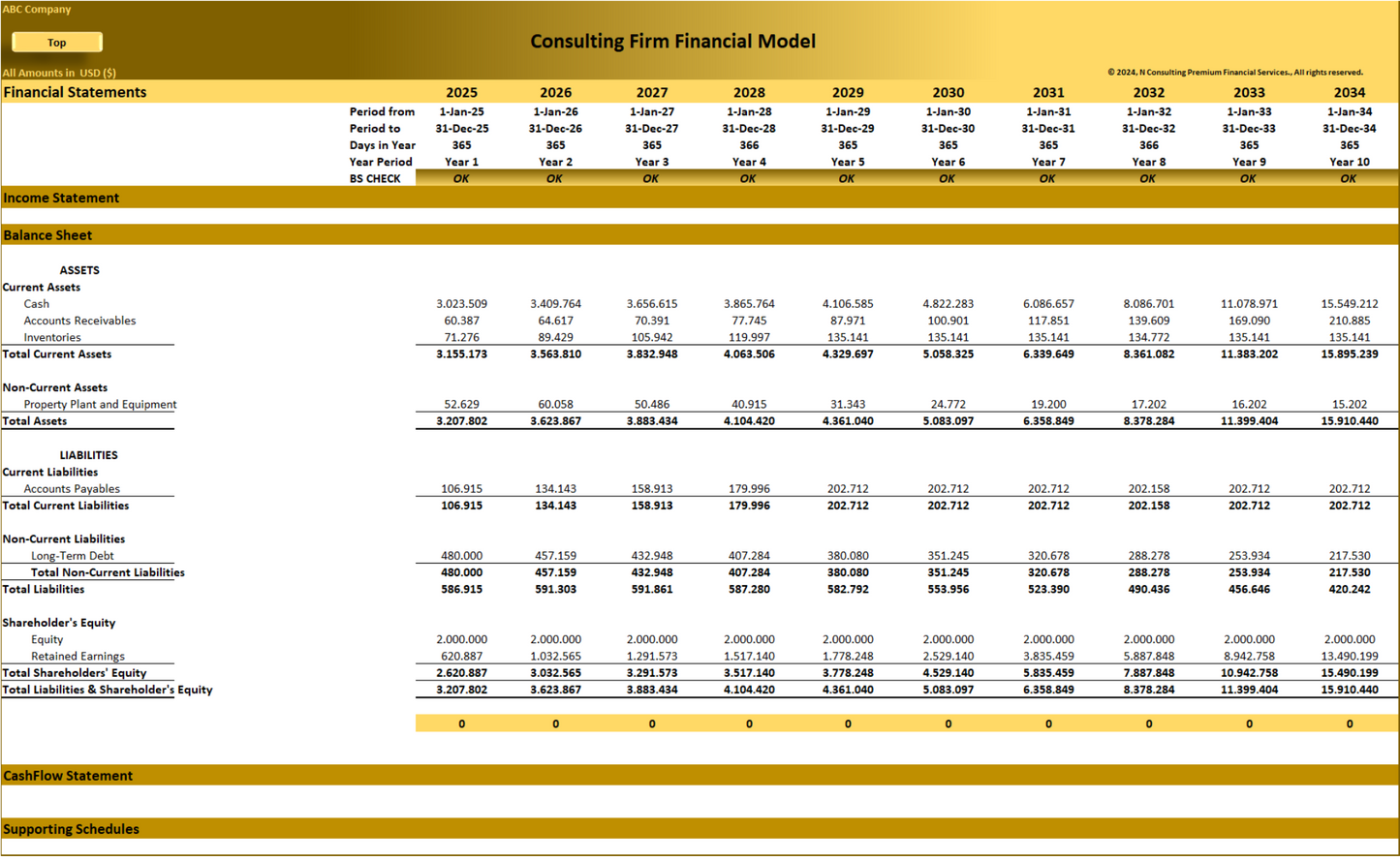

- Profit & Loss Financial Statement: Five years annual projections

- Balance Sheet: Ten years of annual projections

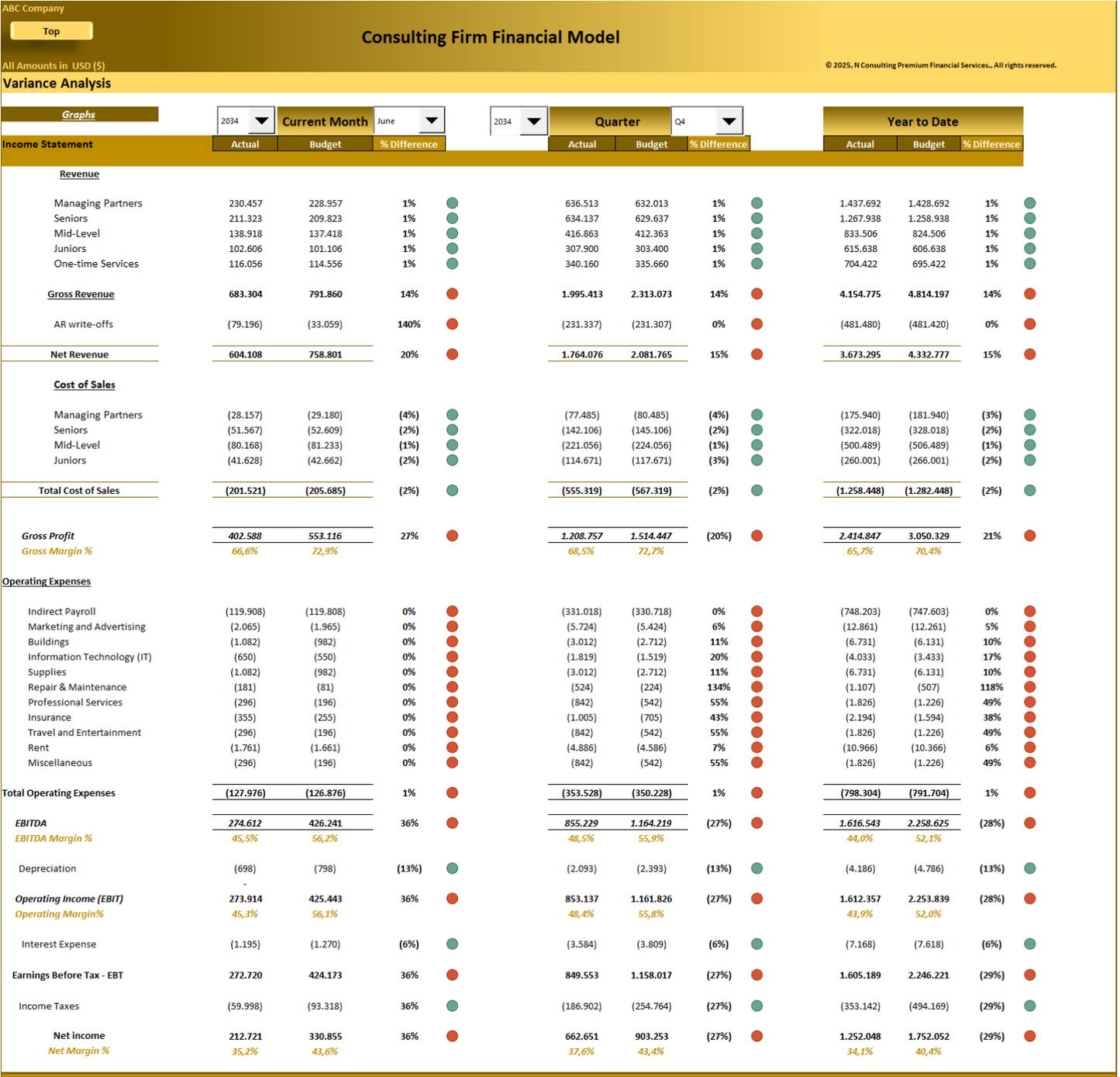

- Variance Analysis: Ten year of comparison Budget vs Actual

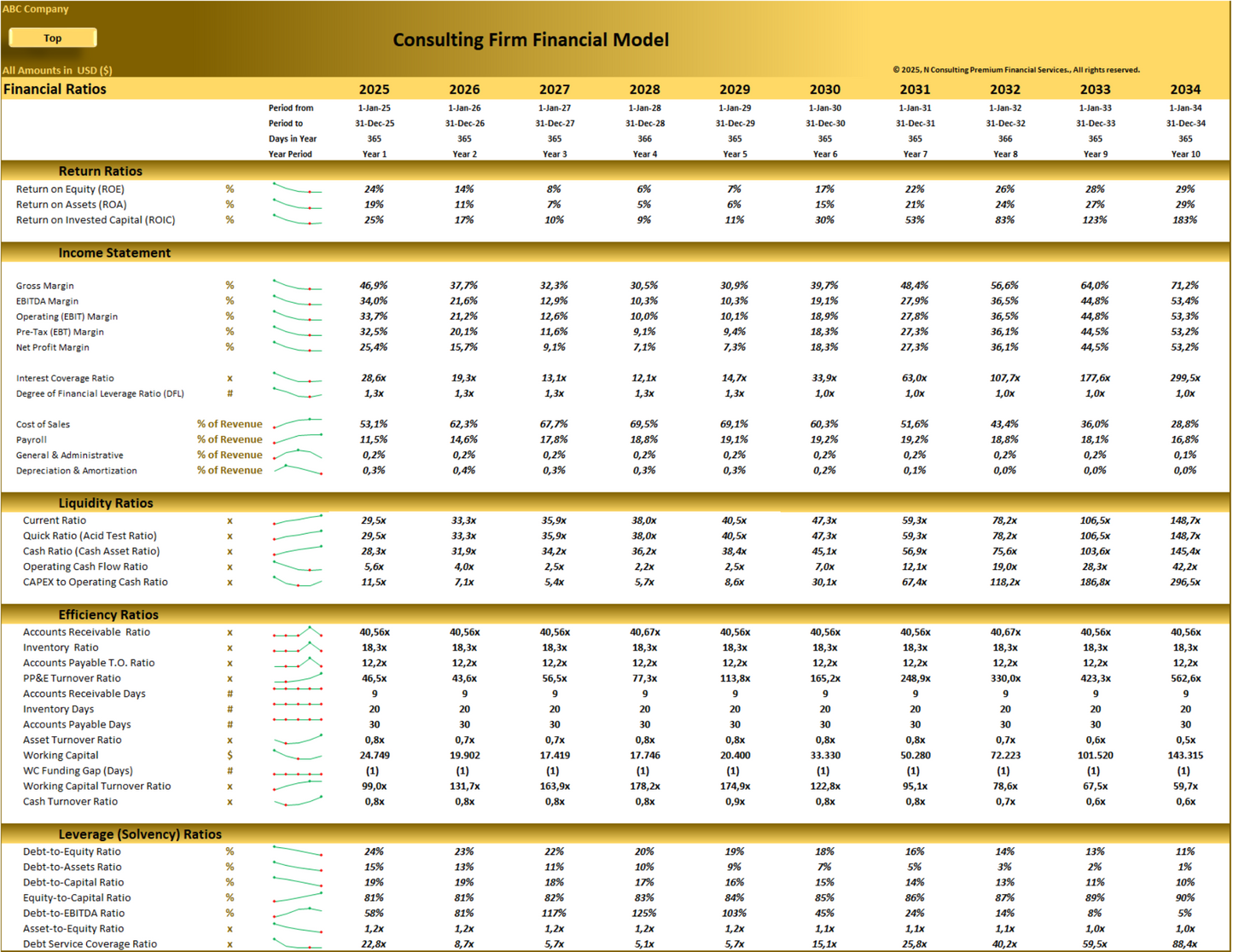

- Financial Ratios and KPIs

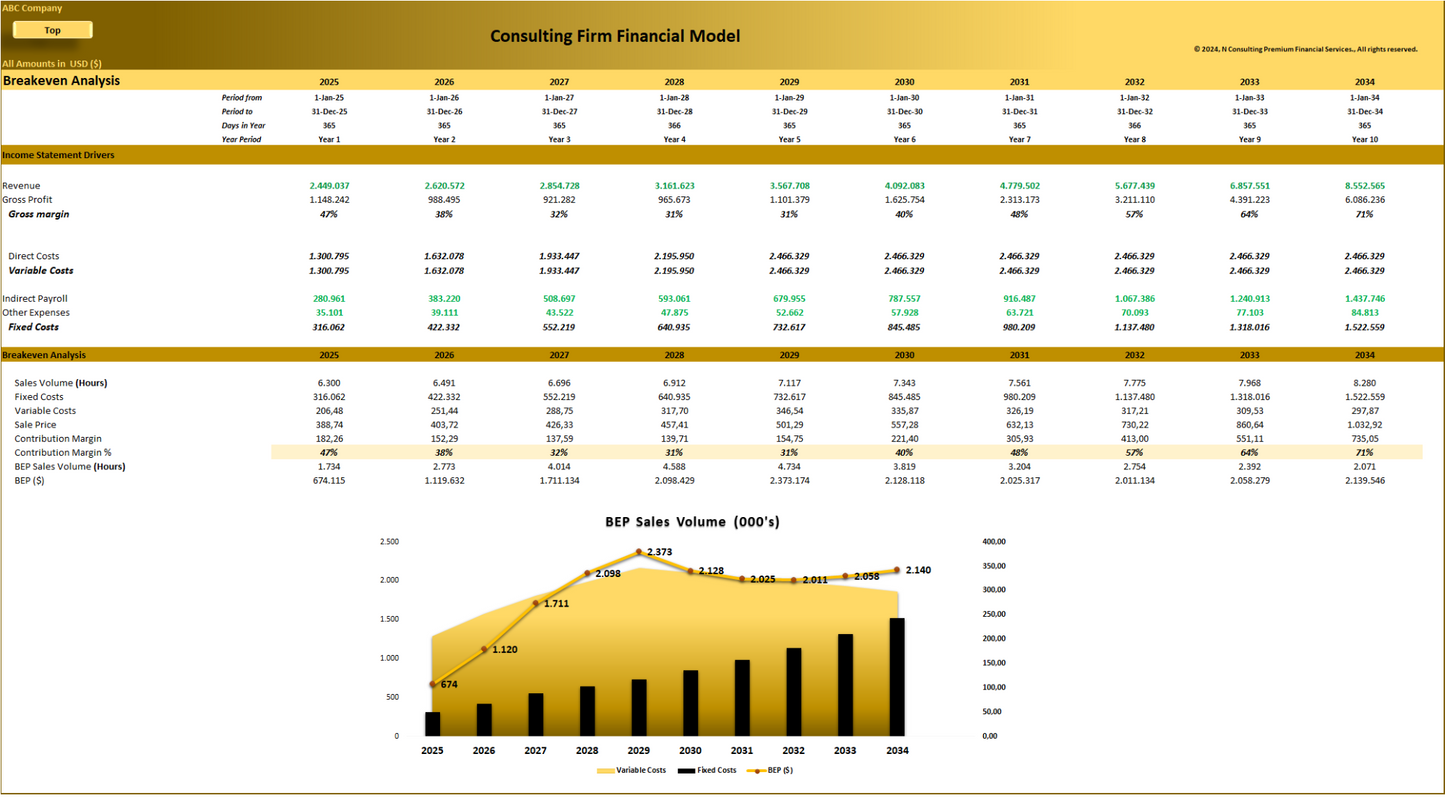

- Break-even Analysis

- DCF Valuation

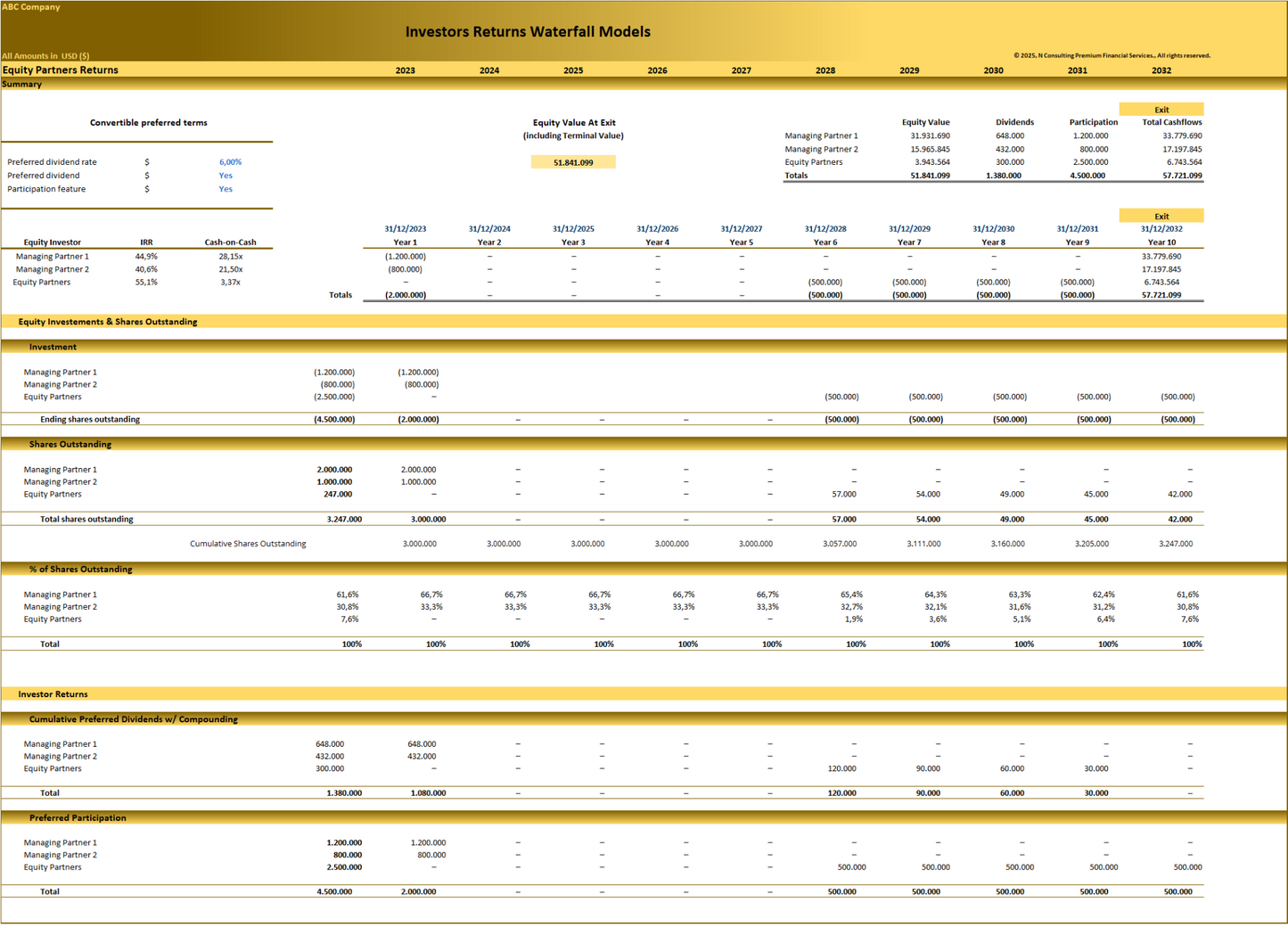

- Equity Partners Returns

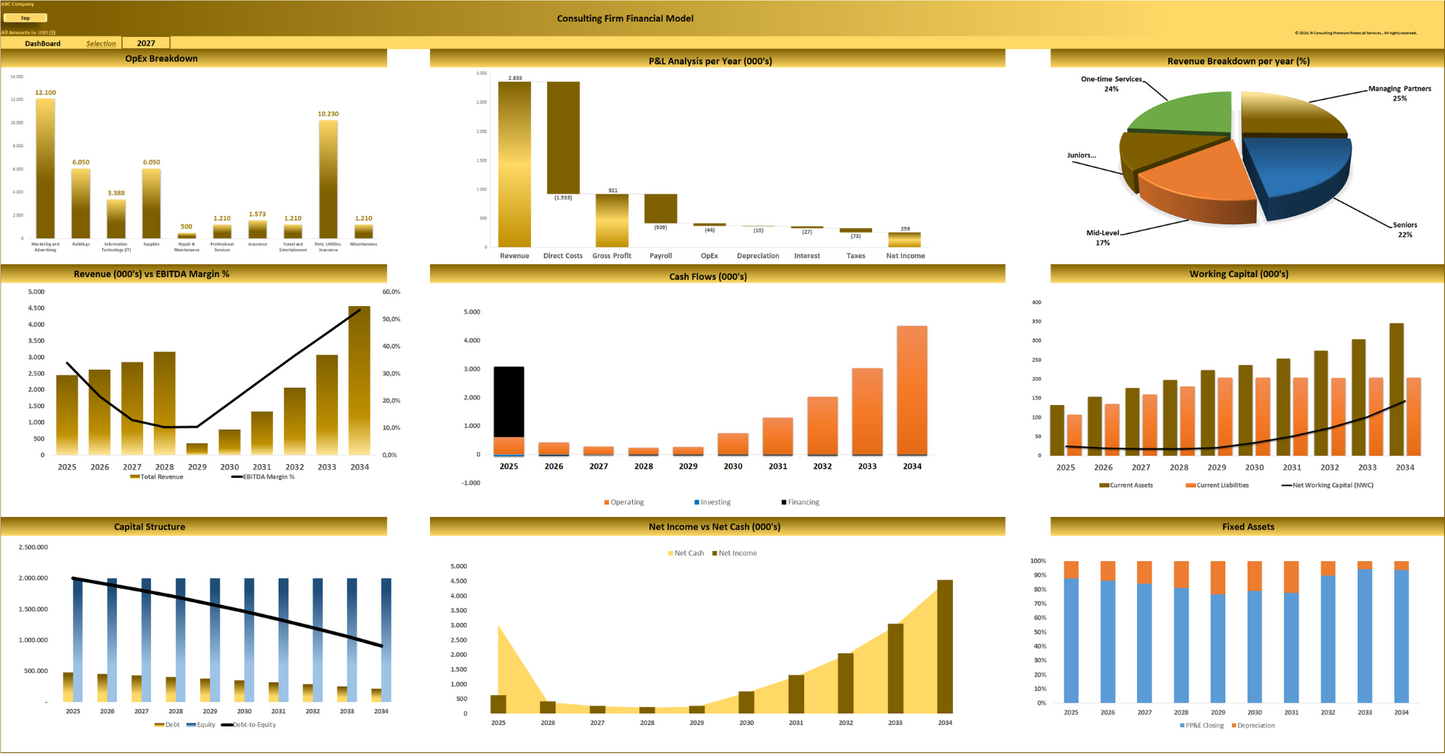

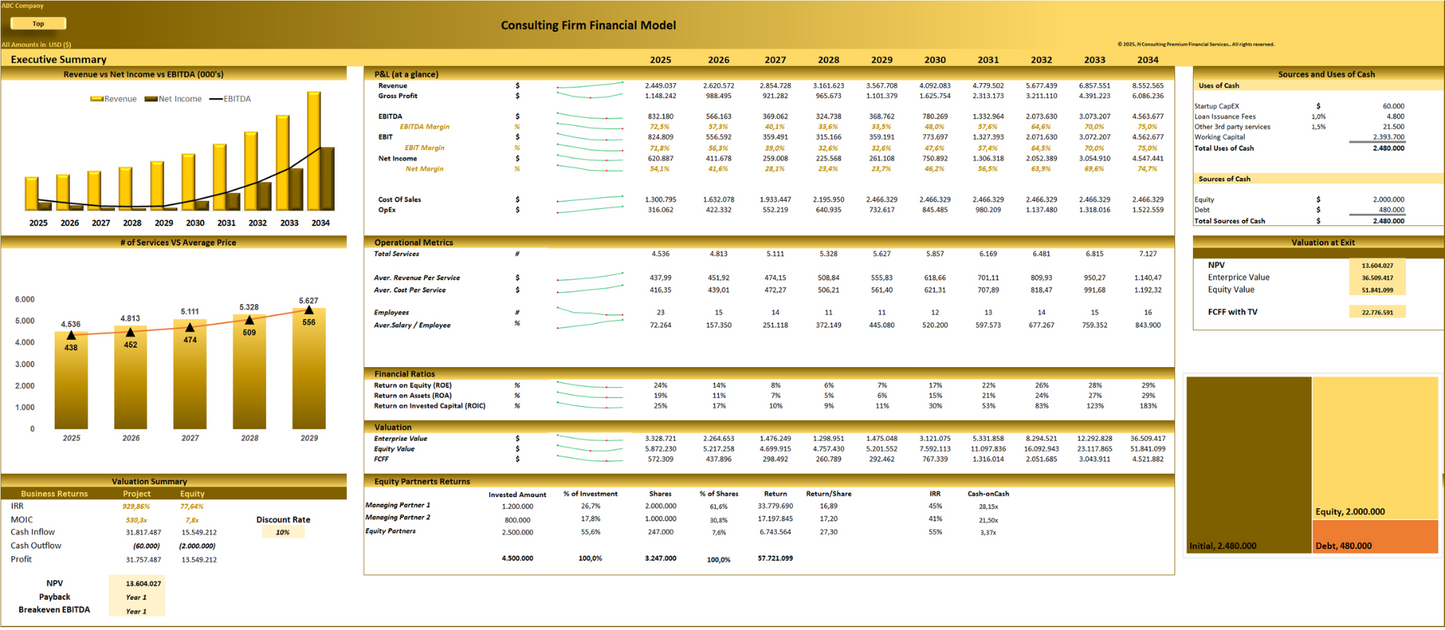

- Dashboard with dynamic graphs.

- Executive Summary

The Version includes:

- Set up Assumptions ( Revenue and Indirect salaries, OpEx, CapEX)

- 10-year Monthly Operating Budget & Actual

- Budget Summary per Year

- 10-year Annual Forecast Financial Statements (3 Statement Model)

- Key Performance Indicators (KPIs)

- Financial Ratios (Income Statement, Liquidity, Efficiency, Leverage)

- Dynamic Performance Dashboard

- Budget vs Actual Variance Analysis for monthly, quarterly, and annual intervals.

- Break-even Analysis

- DCF valuation with Return Metrics (NPV, EV, IRR, MOIC, ROI, etc.) and Sensitivity Analysis

- Equity Partners Waterfall Model (Analysis & Returns per partner )

- Executive Summary

*** The numbers in the screenshots are indicative for demonstration purposes. The PDF refers to all sheets in this version.

About us

At N Consulting, we specialize in delivering top-tier financial modeling services tailored to meet the unique needs of businesses across various industries.

Our expert team creates detailed financial models that support strategic decision-making, optimize financial performance, and drive business growth.

We navigate our customers in the deep water of entrepreneurship by providing forecasting, budgeting, and valuation to empower your financial planning and ensure your company’s success.

Help & Support

If you encounter any issues with this model, please do not hesitate to contact our support team for prompt and comprehensive assistance

Share